Make sure you are fully prepared for Making Tax Digital. Discover what the legislation means for you, who it applies to, key deadlines, and how David Howard can support your business every step of the way.

What Is 'Making Tax Digital'?

Making Tax Digital (MTD) is a government initiative designed to modernise the UK tax system by replacing paper-based processes with digital tax reporting. The aim is to improve accuracy, reduce errors, and streamline tax submissions for individuals and businesses. If you’re self-employed or a landlord, you must transition by April 2026 to avoid penalties

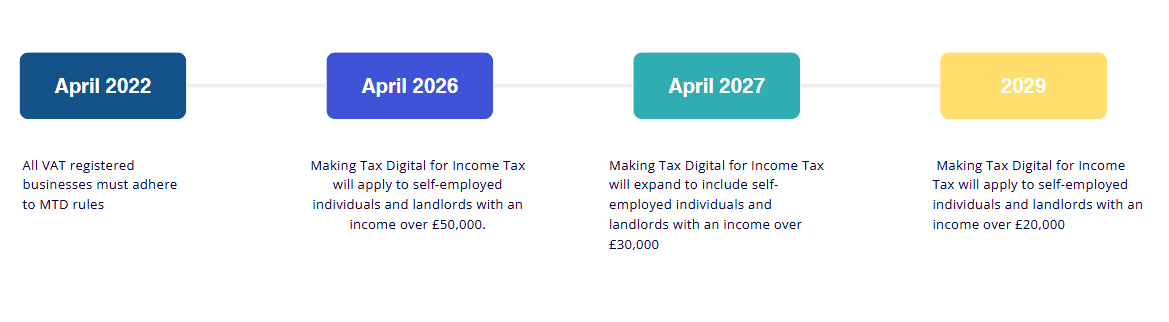

When is Making Tax Digital Happening?

What do you need to do?

What is Making Tax Digital for Income Tax?

Making Tax Digital for Income Tax, previously known as 'MTD for Income Tax Self Assessment' or 'MTD for ITSA', will replace the current system of annual Self Assessment tax returns. MTD for Income Tax will come into effect in April 2026 for self-employed individuals and landlords with income of more than £50,000, in April 2027 for those with income over £30,000, and by 2029 at the latest for those with income over £20,000.

At a glance – What’s changing?

From April 2026:

-

4 quarterly updates per business

-

1 annual final declaration per individual

-

Filing through MTD-compliant software

-

Digital records required

What is Making Tax Digital for VAT?

MTD for VAT requires all VAT-registered businesses to keep digital records and use MTD-compatible software to submit VAT returns electronically.

Accounting software for Making Tax Digital

Xero

Xero is award-winning software that simplifies MTD compliance, boosts reporting, and helps us support you with timely advice and insights.

Learn More.png?width=842&height=842&name=Quickbooks%20(1).png)

Free Agent

FreeAgent makes MTD simple with easy-to-use tools, real-time insights, and smooth collaboration between you, your accountant, and bookkeeper.

Learn More.png?width=842&height=842&name=Quickbooks%20(2).png)

QuickBooks

QuickBooks simplifies MTD for Income Tax with smart tools, real-time data, and seamless collaboration between you, your accountant, and bookkeeper.

Learn MoreYour questions, answered

MTD began in April 2019 for VAT-registered businesses over the £85,000 threshold and was extended in April 2022 to all VAT-registered businesses.

Upcoming milestones for MTD for Income Tax (ITSA):

-

April 2026: Applies to self-employment and/or property income over £50,000

-

April 2027: Applies to income over £30,000

Still to be confirmed:

-

Rollout for those earning under £30,000

-

MTD for general partnerships

-

MTD for Corporation Tax (limited companies)

Penalties for Non-Compliance with MTD

Penalties vary by offence and may include:

-

£400 per improperly submitted VAT return

-

£5–£15 daily fines for failing to implement digital links

-

Up to 100% of VAT owed for errors in submitted records

-

30% of the VAT assessment if underpayment isn’t reported within 30 days

Businesses can still use spreadsheets. Linked cells and Excel formulas are valid MTD digital links.

Failure to comply may result in penalties, though HMRC has indicated it will take a light-touch approach initially. However, it is advisable to take proactive steps towards compliance to avoid issues later on.

You will need to keep separate digital records for each source of income and submit individual updates and End of Period Statements for each.

Act Now to Stay Ahead of Making Tax Digital

Unlock cost-effective accounting, tailored tax advice, and efficient solutions designed to keep your business compliant and ahead of deadlines.